Cập nhật What is a mandate? Process of making payment for payment authorization 2021

Chào hồ hết các bạn bạn đọc thân mến, là 1 người hay tìm tậu online trên mạng nên tôi dành thời kì Phân tích hầu hết về những sản phẩm mà mình định tậu . Tôi nghĩ rằng bất cứ ai trong số những bạn khi tìm một sản phẩm nào đấy cũng đã từng lưỡng lự không biết chọn lựa sản phẩm nào là rẻ nhất trong muôn ngàn các loại sản phẩm và thương hiệu đang mang trên thị trường .

với mong muốn đem lại cho các bạn những bài viết Phân tích chất lượng phải chăng nhất. có phương châm tốt nhất, mới nhất, phù hợp nhất và sẽ luôn cập nhật liên tục các sản phẩm mới vừa được chính thức ra mắt và hoàn toàn phù hợp mang mỗi nhu cầu cá nhân của người mua.

ngoài ra , vuongchihung cũng sẽ chọn lọc và tổng hợp những nơi bán uy tín nhất. trong khoảng đấy, mọi Các bạn sẽ luôn được đảm bảo về việc sử dụng nhà sản xuất tìm mua online và nhận lại được những sản phẩm xứng đáng mang niềm tin đã trao cho thị phần này.

toàn bộ các bài viết review phân tích trên đều được tổng hợp chăm chút và gần như chi tiết thông tin để giúp bạn đọc nắm bắt được nhanh nhất, qua đấy mang cho mình sự chọn lọc đúng đắn nhất

Trong khuôn khổ bài viết này, mình xin mạng phép giới thiệu đến quý đọc nhái của vuongchihung về chủ đề What is a mandate? Process of making payment for payment authorization 2021

Currently, when you need to pay for any individual or organization, you can choose from many transaction methods. In particular, payment authorization is one of the popular transaction orders, trusted by account holders when transferring large amounts of money. However, many customers still do not understand What is a power of attorney?. Therefore, in today’s knowledge summary, Beat Investment will help you understand the concept, classification, and payment authorization process.

What is a spending mandate (what is a UNC)?

Mandate of expenditure (UNC) is a form of transaction through intermediaries. Accordingly, the intermediary on the banking line transfers money from the payer’s account to the beneficiary. This means that the payer enters the payment order on an online form provided by the bank. Next, the payer will ask the bank, where they have registered the account, an amount with the value stated on the payment order and pay the beneficiary.

In simpler terms, a payment order is a form of transaction document. This type of document is created by the payer himself for the purpose of telling a story to the bank to proceed with the payment of the amount to be paid to the beneficiary.

You should note that the authorization must be made by the customer himself, confirmed by a clear signature. The banker is only responsible for the money to be transferred to the beneficiary based on the payment authorization letter.

In English, authorized chi also means Payment order or command UNC. The transaction process through the form of payment authorization is usually done between two accounts in the same or different banking system.

In case, UNC makes between two accounts in the banking system, the money will go directly to the diabetic account. If the two accounts are not dependent on the bank, the money sent to the beneficiary must be transferred to the transfer account.

You may be interested in: Which bank should I deposit my savings with? Top 10 banks with the highest interest rates

Subjects participating in the authorization

The payer is the party that directly prepares the payment authorization letter

In any authorization order, there are always 3 main subjects involved. Includes payer, remittance bank and beneficiary account’s bank.

- Paying party: It is the party directly making the payment authorization letter. In the process of making a payment order, the payer must fill in all information according to the bank’s form. Then proceed to sign and stamp for confirmation.

- Money transfer bank: Responsible for checking and validating all information provided on the payment authorization. In case of detecting errors, the bank will return the payment authorization letter to the customer. If the customer’s account balance is insufficient to make the payment, the bank is also obligated to notify the depositor.

- Bank side of beneficiary account: Responsible for receiving money, saving transaction details, and informing beneficiaries.

Pros and cons of payment authorization transactions

The form of payment authorization transaction is very popular in our country. The advantage of this form lies in the strict process, which makes it difficult for mistakes to happen. However, there are still some disadvantages associated with it.

Advantages

- The process of payment authorization transactions at banks takes place extremely closely, there is no need to worry about loss occurring.

- Money is transferred to the processing account quickly and safely.

- The bank will pay directly to the beneficiary.

Defect

- The authorized person still has to pay the transaction fee.

- The procedure to make a payment authorization letter can be time-consuming because the payer, even if he registers online, still has to go to the bank.

Classification of forms of authorization

Banks now support online authorization customers to save travel time. In addition, if you want to be more certain or need to pay a large amount, you can still go directly to the bank’s counter to make a payment authorization.

Online payment authorization

With online payment authorization form, customers can fill in the payment authorization form on the bank’s website. After completing the registration form, you just need to download, print it and bring it to the bank to request a payment authorization.

Direct payment authorization at the counter

In case you do not want to make a payment authorization letter online, you need to go directly to the transaction counter of the registered bank to make a payment authorization form. Here, the bank staff will ask you to fill in the form to make a payment authorization. After confirming all information with the customer, the bank will immediately transfer the money to the beneficiary’s account.

Detailed regulations on payment authorization and tax authorization

The person making the payment authorization must be the account holder or an authorized person. In addition, the payment authorization letter presented according to the available form includes all information of the account holder as the beneficiary. Only banking institutions or state treasuries have the right to perform payment orders at the request of depositors. The amount of money sent via UNC is not limited, so why can’t the sender’s account be able to pay.

According to Decree 91/CP issued on November 25, 1993, collection authorization and payment authorization (money transfer) are two legal forms of payment.

Payment authorization – money transfer

It is the transfer of funds from the account holder to the beneficiary. Payment authorization is like a form of payment for products and services, transferring money to an account inside or outside the banking and treasury system.

Authorization to collect

Made by the beneficiary when they have completed the order. The buyer and the seller need to agree to pay through the collection order.

In which, all conditions and regulations need to be fully detailed in the economic contract. At the same time, they must be notified in writing to the bank. This is the basis for the bank to perform collection authorization transactions.

When the order has been completed or the service provided has been completed, the beneficiary must make a collection authorization. The collection authorization letter must also follow the form of the bank. Then, send it directly to the bank or the state treasury.

You may be interested: Latest bank loan interest rate update 2021

How to write a bank’s payment order?

A valid payment authorization letter must include all the information required by Clause 2, Article 13, Decision 226/2002/QD-NHNN issued in 2002. Accordingly, each payment authorization letter needs to include the following items: content below.

- Serial number of the power of attorney.

- Full name, address and account number of the depositor.

- Full name and address of the bank or treasury that authorized the payment for the customer.

- Full name, address and property number of the recipient (beneficiary).

- Full name and address of the organization supporting the payment of services to the beneficiary.

- The payment amount must be written in both words and numbers.

- Date of birth of the authorized person.

- Signature of the account holder or authorized person.

Instructions on how to make a power of attorney

Customers can make payment authorizations online or at the counter. However, no matter how you do it, you still have to provide information at the request of the bank.

Customer section

- Time of payment authorization (date of paper making).

- Paying unit: The transfer account number, name of the account holder, the amount to be transferred (in words and numbers), the content of the transfer, and the fee (payer or payee) must be included.

- Recipients: Include name, beneficiary account number, bank name of beneficiary account.

Bank section

This part will be provided by the bank. Includes information about journal entries, tellers, and controllers.

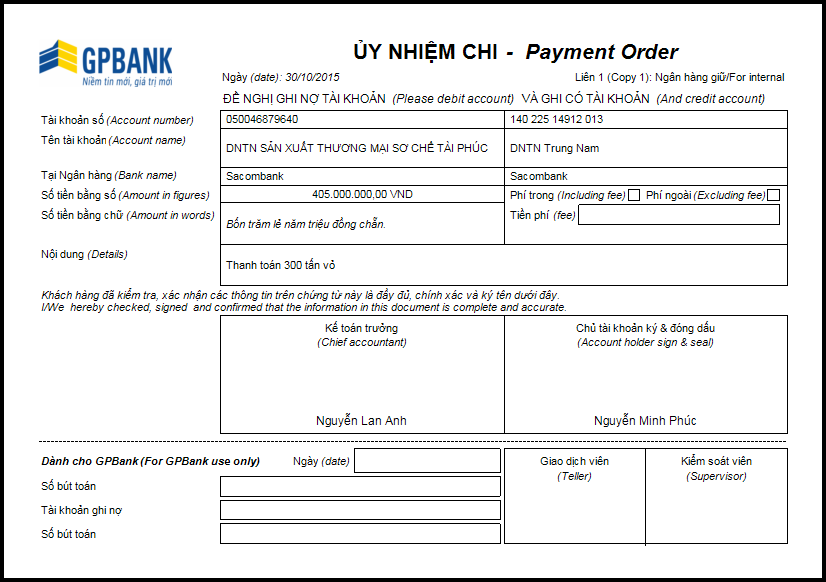

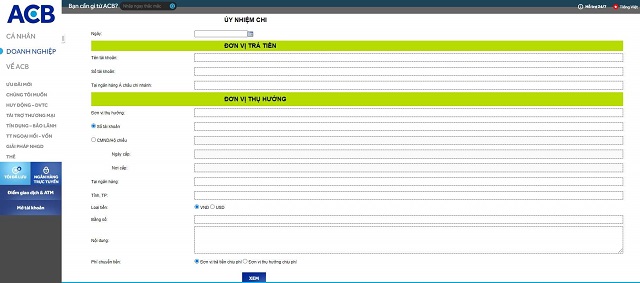

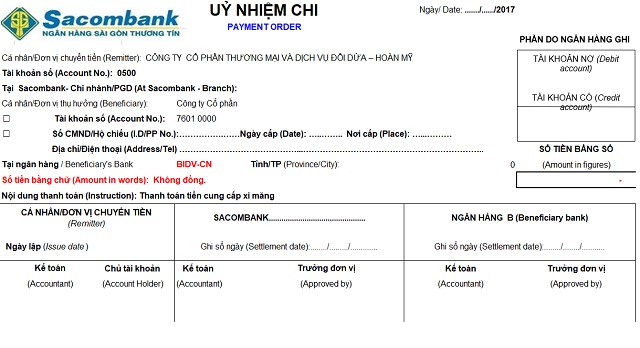

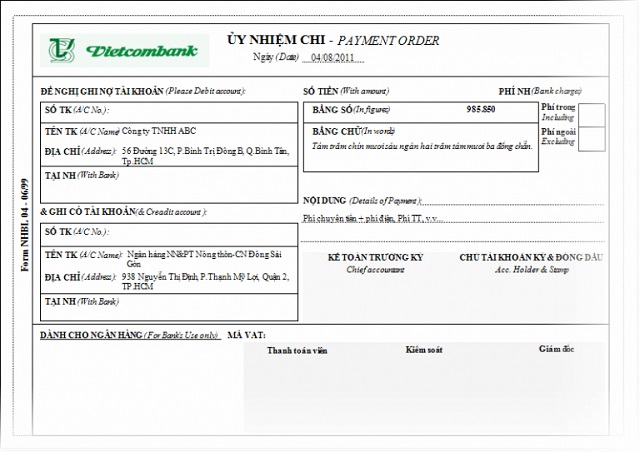

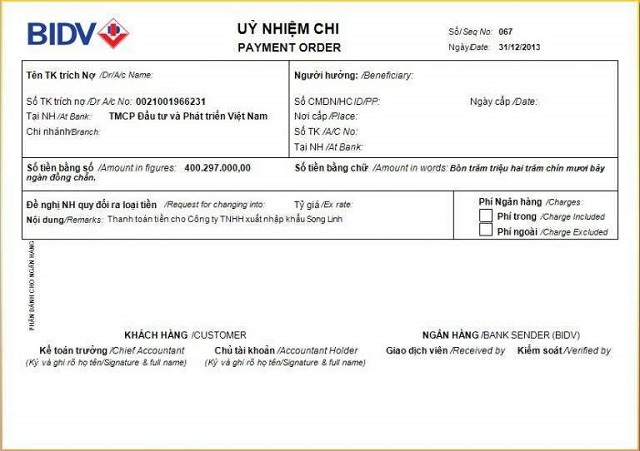

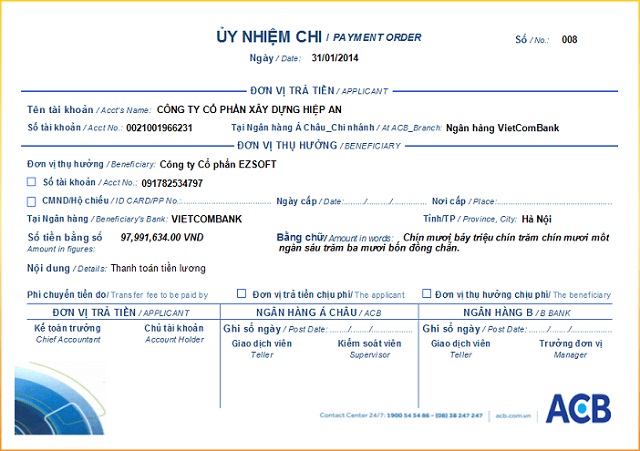

Sample payment authorization letter of some big banks

If you still don’t have a clear picture of the paper What is a power of attorney?Please observe the payment authorization form at some of the major banks below.

It can be seen that though the presentation may be slightly different. However, the basic information on the payment authorization form at the banks is quite similar. When creating a payment order, you need to pay attention to fill in all the required information that the system has requested.

Payment authorization process

The payment authorization process needs to take place fully and sequentially in 3 steps.

Step 1: Make a payment authorization

The payer must first make a payment authorization letter if it needs to transfer money. The payment authorization letter must be made at the same bank where the payer has registered the transaction account. Note, even if you make an online payment authorization form, you still have to bring this document to the bank for the bank fee to confirm and proceed with the money transfer.

Step 2: Control the authorization

On the bank’s side, once they have received the payment authorization letter, they must conduct control to ensure that this document is a legal contract. Also in this step, the bank will check the remaining amount in the payer’s account. The balance in the sender’s account must be enough or more than the amount you want to send to the beneficiary’s account.

In the event that a mistake is discovered in the payment authorization letter, the bank may ask the customer to make a copy or redo the whole thing from scratch.

Step 3: Processing documents and accounting

If the payment order as well as the depositor’s account is valid, the bank will start processing the documents. Then transfer money at the request of the customer. Usually about 1 day, the money will be transferred to the beneficiary’s account.

You may be interested: What is charter capital? Role, meaning & regulations on charter capital

When performing a payment authorization transaction

Any customer can do it, authorized by the province. However, to make this process go quickly, you should keep a few notes in mind below.

- Check the remaining amount in the account to see if there is enough money to make the payment authorization transaction. If the account is not enough, you need to transfer more money.

- Customers can trust the bank’s payment authorization form and fill out the information in advance at home. Thus, when you bring the paper to the bank, it will be processed immediately.

- The information on the power of attorney must be provided accurately so that it does not take time to adjust or redo.

Above, beatdautu.com just shared the most basic knowledge related to spending authorization. In essence, this is a type of money transfer transaction through an intermediary that is a bank or state treasury. These intermediaries will transfer money from the account of the author of the payment order to the account of the beneficiary.

With a payment authorization transaction, customers can rest assured that the money will be accurately transferred to the beneficiary’s account. The payment process is tight but still very quick. Come here, hope to ask questions What is a power of attorney? has been clarified by Beat Investment!

ID code: u435

Hệ sinh thái cộng đồng của BD Ventures: https://linktr.ee/bdventures